AI Wealth Management

Using deep learning and neural networks to analyze market data and identify the best investment

opportunities.

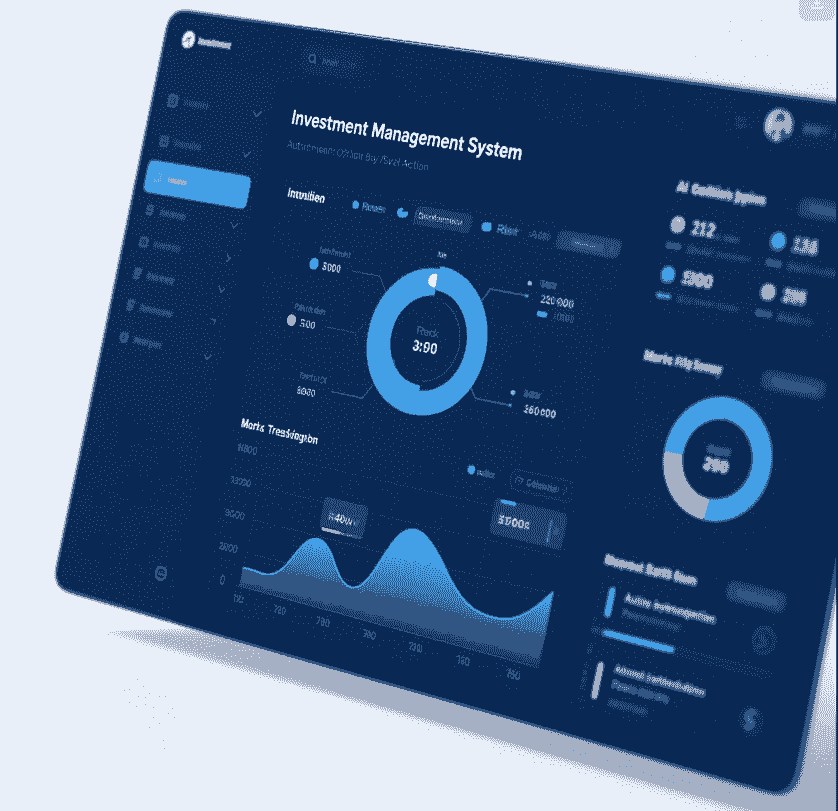

AI Trading Technology

- Utilizes deep learning and neural networks to analyze market data and identify the best investment opportunities.

- High-frequency trading AI automatically executes optimal buy and sell strategies, improving trading efficiency.

- Risk management AI analyzes historical data and market sentiment, adjusting positions in real-time to ensure asset safety.

Auto-Investing

- Users can set investment goals and risk preferences, and AI automatically allocates funds.

- AI identifies market trends and automatically executes the best buy and sell actions.

- Suitable for long-term investors, enabling passive income growth.

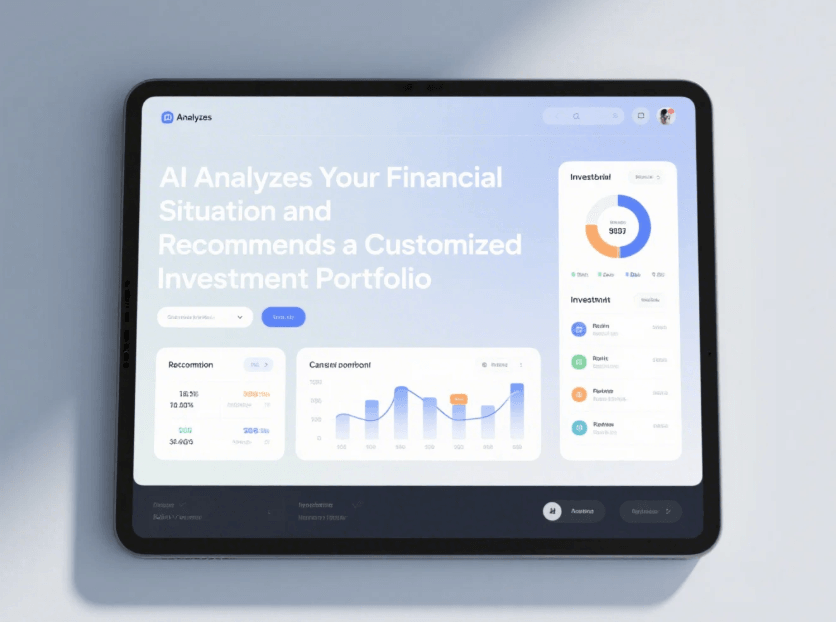

Personalized Investing

- AI analyzes the user’s financial situation and recommends a customized investment portfolio.

- Dynamically adjusts the portfolio based on market conditions, personal preferences, and risk tolerance.

- Provides diversified asset allocation, including stocks, bonds, ETFs, cryptocurrencies, and more.

Dynamic Portfolio Rebalancing

- AI continuously monitors market changes and automatically adjusts assets to optimize returns.

- Combines AI prediction algorithms to dynamically adjust positions, reducing the impact of market fluctuations.

- Offers automated stop-loss strategies to minimize investment risk.

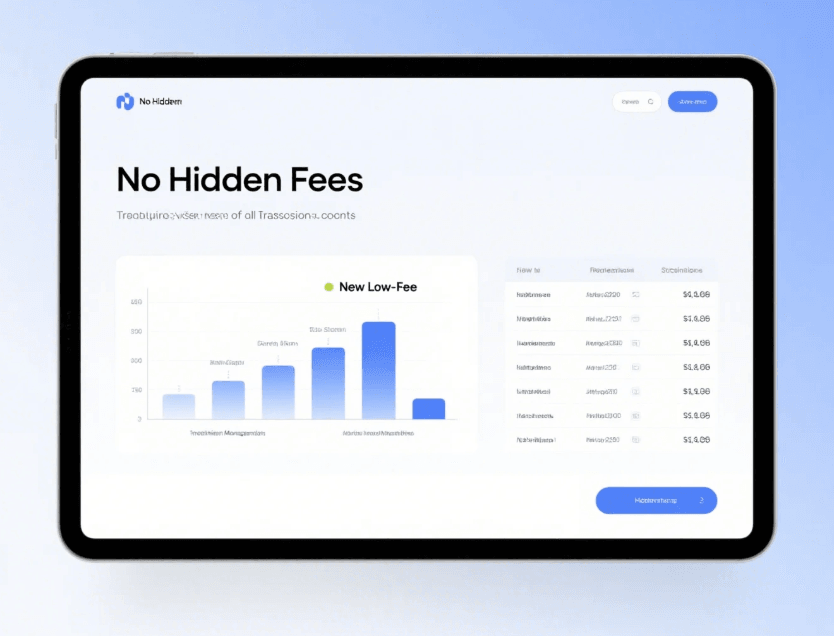

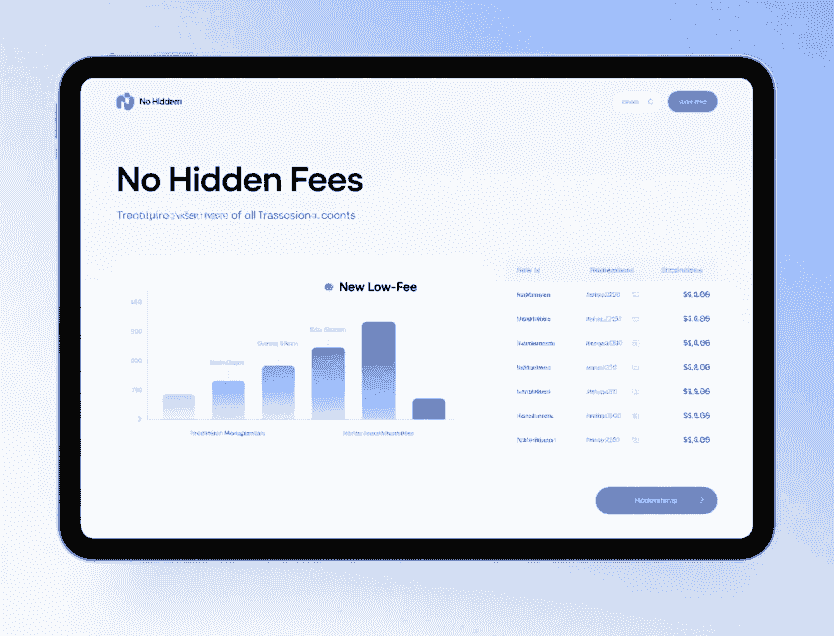

Fees & Transparency

- No hidden fees, with all transaction costs being transparent and visible.

- Uses a low-fee structure, reducing costs by 50% compared to traditional investment management.

- Users can view fee details at any time, ensuring transparent and controllable use of funds.

Resources

Tutorials

Brand Assets

Contact Us

support@

© SmartsAI Contracts 2025 – All Rights Reserved.

Terms & Conditions

Privacy Policy